Who is Mr. Supply Chain Visibility? And why has he transformed from a “nice-to-have” to a “must-have” consultant following the launch of the Goods & Services Tax (GST) in India?

An excerpt of this article was featured in Cargo Connect Page78.

GST or Goods and Services Tax - Some love it, some hate it, and some are still getting accustomed to it. No matter how you feel, there is no denying that GST is a historic event in India’s tax reforms.

On the night of 30th June, 2017, GST was launched in a ceremony held at the Central Hall of Parliament - the same location where India’s independence was first celebrated more than half a century ago. At the stroke of the midnight hour, when the world slept, Indians awoke to “One Nation, One Tax.” GST put an end to over a dozen different local, state, and central taxes (such as VAT, Sales Tax, Service Tax, Entertainment Tax, Octroi, Central & Additional Excise Duties and Additional Customs Duties), and setup a digital, single-window taxation system in the form of the GST Network (GSTN).

The concept of GST is not new to the world - it exists in more than 140 countries around the globe – and its impact on supply chains in the countries where it exists is profound.

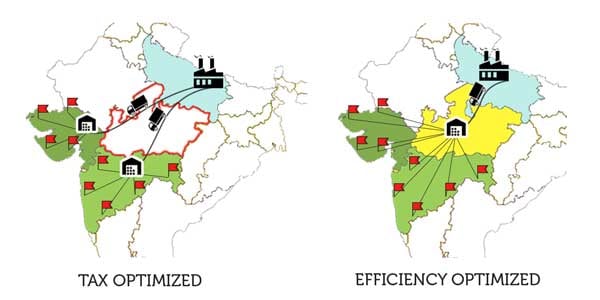

So, how does GST impact supply chains? In India, it initially presents the opportunity for a complete supply chain network overhaul! Prior to GST, when states had high autonomy in imposing taxes, supply chains were built to be “tax optimized” to ensure the goods travelled to their end customers in a manner which provided the lowest accumulated state taxes.

Let us study the logistics network of a consumer goods company who manufactures locks in Aligarh, Uttar Pradesh (located in the North of India) where raw material and skilled labour is readily available, but most of its customers are in the states of Maharashtra and Gujarat (located in Western India). To serve the western Indian markets better, they determined that the best warehousing location was Bhopal in the state of Madhya Pradesh (which is located in Central India). Yet, they could not go ahead with this plan prior to GST because they would have had to pay taxes to Madhya Pradesh, before transporting their goods onward into Maharashtra or Gujarat – even if no locks were sold in Madhya Pradesh. Maharashtra would not allow them to claim an “input credit” on taxes paid in Madhya Pradesh – leading to double taxation. Therefore, the company was forced to setup warehouses in both Gujarat and Maharashtra (two warehouses in the place of one) to avoid this double taxation issue. They still saved money overall through lower taxes, but could not run their logistics and warehousing operations at the cost and efficiency they truly could have.

With the advent of GST, a simplified, universal destination based taxation system, the same company now has the freedom to choose Bhopal in Madhya Pradesh as their warehousing location since that makes more business sense. In the post GST era, many companies, small and big, are restructuring their warehousing locations and transportation networks to be “efficiency optimized” versus “tax-optimized.”

The big question now is, who is Mr. Supply Chain Visibility and how can he help you improve business efficiencies in a GST environment?

Meet Mr. Supply Chain Visibility

“Mr. Supply Chain Visibility” is any end-to-end, real-time monitoring solution that enables your enterprise to follow its goods from the point of manufacturing to the point of sale – at a package-level. With real-time insights about your goods movement and intelligent decision-making abilities, Mr. Supply Chain Visibility can make the right recommendations to help you reduce your supply chain and logistics cost.

Why Is Mr. Supply Chain Visibility in Demand With GST?

The “efficiency optimized” world (like one with GST) is all about the survival of the fittest. Just having a great product does not determine your success in the marketplace. To stay competitive, you need to ensure that your product is delivered to your customer quickly and in top quality. If your product is sensitive to environmental conditions like temperature, pressure, humidity, or shock; monitoring it throughout its journey becomes even more vital. Lowering your warehousing, logistics, and transportation cost will further help you stay competitive in terms of pricing.

Mr. Supply Chain Visibility is in demand with GST because he,

- Gives your real-time insights about your goods in the warehouse and in-transit

- Ensures your goods reach their destination on time and in prime condition

- Provides actionable insights about your supply chain for you to optimize it for speed, cost savings, and quality management

How Can You Save Cost With Mr. Supply Chain Visibility In Times Of GST?

Let us see how Mr. Supply Chain Visibility can help you save money that was never possible before the launch of GST.

1. Saving Through Faster & Safer Logistics

In a GST environment, the smart logistics strategies like Just-In-Time (JIT) Inventory models and reduction in detention times can be achieved easily because external factors like tax check post delays don’t exist. Here are some areas where supply chain visibility is helping companies save money.

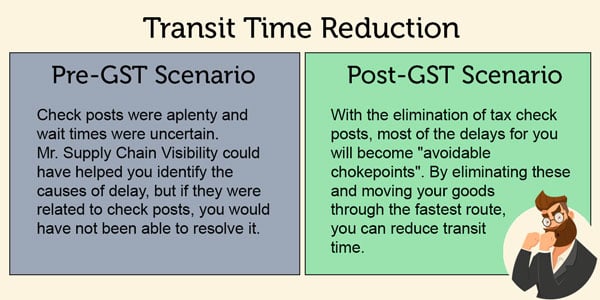

a. Transit Time Reduction

Mr. Supply Chain Visibility can “heat map” your routes to help you choose the shortest path in terms of transit time. Visibility will also help you know if your transporters are in compliance with the assigned routing.

A 1-day reduction in transit time from a standard 5-day journey means that you have 73 extra days per year to use your vehicle. This is a 25% jump in vehicle utilization or a 25% reduction in cost per trip.

Even if you do not own your fleet, you can share the savings that your logistics provider realizes.

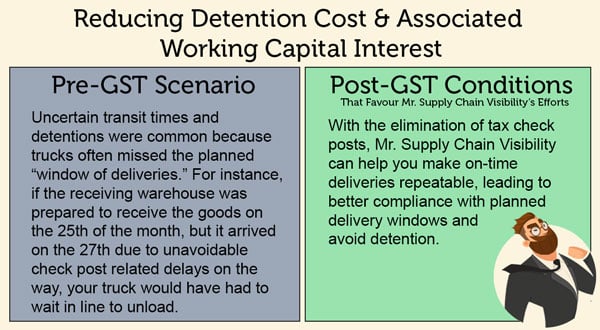

b. Reducing Detention Cost & Associated Working Capital Interest

Supply Chain Visibility, coupled with an ePOD solution, can help you identify precisely when your truck arrives at your warehouse as well as when the “Proof of Delivery” is signed. By knowing where most of your detention is happening and reducing it over time, you can significantly save on this hidden cost while improving the availability of your working capital.

Let us assume that the detention charge per day is ₹ 1,000 / $15 / € 13 for a full-truck load. Assuming 25% of your 10,000 annual shipments face a detention of 1 day each, you can save ₹ 25 Lakh / $38,400 / € 33,000 annually.

Further, the associated working capital with this delay is about ₹ 2,500 crores / $ 384 million / € 333 million (assuming the truckload is worth ₹ 1 crore / $ 153,000 / € 133,000 each). If you are saving 1 day of the working capital interest (at a 10% borrowing rate) on these 2,500 loads (or 25% of your loads), that is a total annual savings of ~ ₹ 68 Lakhs / $104,000 / € 90,000.

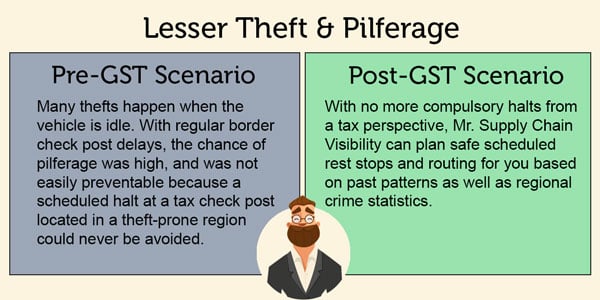

c. Lesser Theft & Pilferage

Mr. Supply Chain Visibility can ensure that route compliance is enforced and unwarranted stops prevented.

The savings from theft can be calculated as the insurance copays that you saved plus the rise in insurance premiums that you avoided (or the no-claim bonuses that you received) by reducing the number of theft incidents.

Improving your transit times, eliminating detention, and better securing your goods will not only bring down your cost of logistics, but also makes you more competitive. You can respond quicker to market demands too and stay ahead of your competitors - both from a stock availability and from a pricing perspective.

2. Saving Through Smart Warehousing

Smart warehousing is not a new concept, but ensuring the warehouse that you setup or rented (sitting kilometers away), is indeed bring managed in a “smart” way is definitely a challenge. Let us examine a few smart warehousing techniques that supply chain visibility can help you implement, and the savings associated with it in a post-GST scenario.

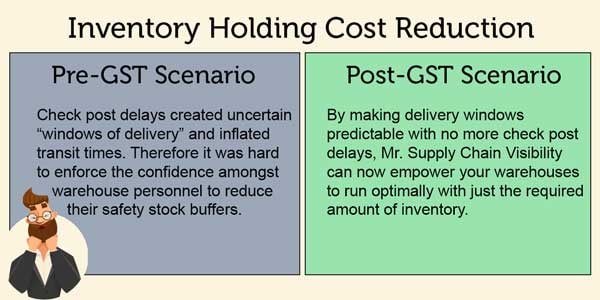

a. Inventory Holding Cost Reduction

By reducing transit time, the amount of inventory stored can also be reduced.

Assume that your trips between Mumbai to Delhi were 5 days. By using route analytics, and considering that there are no check post delays owing to GST, you have brought it down the 4 days - this is an entire day's reduction in the safety stock requirement for your regional warehouse.

This 1-day saving translates to a 20% reduction in your warehouse space and warehouse operating costs, apart from a quicker time to market.

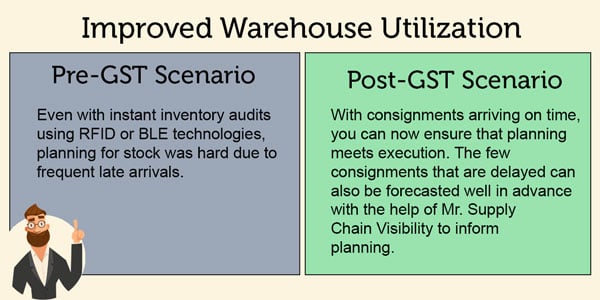

b. Improved Warehouse Utilization

With instant inventory audits using supply chain visibility technologies like BLE beacons, you will be able to find the item you want to ship immediately, or promptly know where to stock the items which just arrived.

This will lead to reduced detention cost and associated working capital (its calculation is shown in the previous section).

A majority of warehousing troubles arise when stock planning does not match on-ground execution. With the predictability that supply chain visibility can bring into your logistics, you will be better equipped than ever to kick-off your smart warehousing program.

Here are 6 ways how you can get started with reducing your warehousing cost & space!

3. Saving By Maintaining Transparent Audit Trails

a. Accurate GST Input Credit Filings

If your annual sales is ₹ 1,000 crores ($ 154 million or € 133 million) and you miss filing your input credit for even 1% of your goods, you will miss obtaining anywhere between Rs 1.5 crore to ₹ 2 crore ( $230,000 to $308,000 or €200,000 to €267,000) in tax input credit - assuming GST is 18% on your goods.

You could miss claiming input credit especially when you have returns or goods sent back to your factory or warehouse for repackaging and rectification.

If you are able to obtain package-level supply chain visibility using technologies like BLE beacons, and have the solution integrated with your ERP or Finance software, you will be able to completely automate your tax input credit filings. While technologies like barcodes can help maintain a clear audit trail, they are cumbersome to use and still prone to manual error.

b. Better auditing of your logistics service provider’s invoices

You can save by catching errors in your transport invoices. Many times, these errors occur in representing “detention” at a location. Since the driver or delivery executive manually records the detention times, there is scope for error.

Also, by monitoring your shipments, you can accurately calculate the distances travelled, transit time and late deliveries if any, and account for differences while auditing your transporter’s invoices.

How to Find Mr. Supply Chain Visibility, Hire Him, And Start Saving Today?

Supply chain visibility solutions, just like your tax or supply chain consultants, come in various forms, shapes, sizes, and most importantly, cost. Just like you have old-fashioned as well as new-age tech savvy consultants, you have older technologies like RFID and barcodes, as well as newer and more scalable/real-time IoT technologies like BLE/GSM.

See why BLE is replacing RFID technology for supply chain visibility.

To give you measureable return-on-investment (ROI), you would need a solution that can monitor your goods across your supply chain at a package-level, and give you actionable insights. Therefore, similar to how you would assess your consultant’s credibility before hiring him or her, it is important to assess the IoT solution you plan to use.

The solution you use must be able to collect package level data across the supply chain, have strong global connectivity, be able to link macro and micro level supply chain data to provide you with trusted analytics, and help you with putting the analytics into action through a control tower.

With many IoT options in the market, it is worth floating an RFP before you get started to make an informed decision and maximize ROI.

Not sure where to get started with finding Mr. Supply Chain Visibility? Download our free RFP creation guide for IoT solutions, and get started with assessing market option. Better yet, want to meet Mr. Supply Chain Visibility? Contact us, we’d be happy to introduce you!